N26 joint account

Your finances — better together

Everything in life is better shared, including money. Keep all your finances side-by-side with your personal account and joint bank account at N26.

N26 joint accounts include handy insights, dedicated IBANs, and easy-to-use features to make managing shared finances a breeze.

What is an N26 joint account?

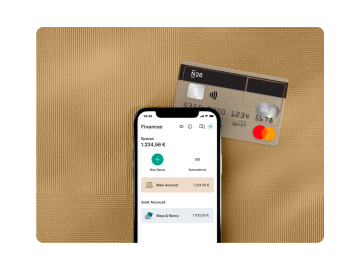

The N26 joint account is a bank account for two people to share. You can use its dedicated IBAN to manage your shared finances, including setting up recurring payments for shared bills. You can also link your N26 card to pay with your shared money.

All customers with a personal N26 account may open one joint account with one other person. It takes just a few minutes and you can do it in the N26 app.

Pay directly from your joint account

Link a virtual or physical N26 card to your joint account for convenient, contactless payments using your shared money — for example for groceries and bills.

Track your budget — together

Managing your budget and spending habits is easy with N26 Insights, even when your finances are shared.

Achieve financial goals together and enjoy 100% transparency as you do it. Filter payments by participant, and use our budgeting tools to oversee your joint finances.

How to open your joint account

- If you're not already an N26 customer, open a personal N26 account

- Select 'Joint Account' from the 'Finances' tab in your N26 app

- Invite one of your contacts to open a joint account with you

- Then both of you must confirm the terms and conditions

- Finished! Enjoy your joint account

Your money is protected

Since N26 is a fully-licensed German bank, the money in your bank accounts — including your joint account — is protected up to €100,000 by the German Deposit Guarantee Scheme.

See how N26 is simply secureEnjoy special deals with N26 Perks

Unlock great discounts from our selection of partner brands with your N26 joint account. Whip up your favorite meal for less with HelloFresh, skip cooking entirely with savings on Wolt, or design your dream home together with Westwing. Perks are updated often, so you can enjoy generous discounts throughout the year.

View partner offers

How many people can use a joint account?

N26 joint accounts can have a maximum of two account holders.

Do I need a personal N26 account to open a joint account?

Yes. First you need to open a personal account and then you will be able to open a joint account.

Can I get two physical cards with my joint account?

Once your N26 joint account is open, you can connect the card linked to your existing N26 personal account to your joint account instead. Alternatively you can connect a virtual card, or buy an additional card that is dedicated to your joint account for €10. Please remember that N26 cards are always issued per person, so it isn’t possible to have a card with both joint account holders' names on it.

How can I open a joint account as a new customer?

First you need to open a personal N26 account. Then you can be invited to be a joint account holder, or open a joint account yourself.

How can I open a joint account as an existing customer?

If you already have a personal account with N26, head to the ‘Finances’ tab of your N26 app. Then add a joint account and choose the contact you want to share your joint account with. Once they accept your invitation and you both accept the terms and conditions, your joint account will be open. You’ll then each be able to transfer money in and out of the joint account.

Who is liable for a joint account?

Each account holder has 100% liability and equally shared ownership of the activity in the joint account.

Whose name is the joint account in?

Both account holders are named on the joint account.

How much does a joint account cost?

The N26 joint account is a free feature available to all N26 customers, regardless of membership type.

Can I switch my joint account from another bank to N26?

Yes, account switching is available.

What’s the difference between Shared Spaces and joint accounts?

Shared Spaces are available only to those with a premium N26 membership. It's not possible to make payments directly from a Shared Space, as they don't have a dedicated IBAN and you can't link a card to them. Each Shared Space can have up to 10 participants, but only the persona who opened the Space is the legal owner of the funds within it. Joint accounts are available to all N26 customers, regardless of membership. They have a dedicated IBAN, and you can link a virtual or physical card to your joint account to make direct payments. Only two people can join a joint account, but both account holders have full legal ownership of the shared funds within it.