N26 Standard

Your free bank account—discover N26!

Founded by Austrians and beloved worldwide, N26 is The Mobile Bank. Open your free bank account now and discover why millions of customers already rely on N26 to manage their money. Sign up online in just 8 minutes—all you need is your smartphone and a valid ID.

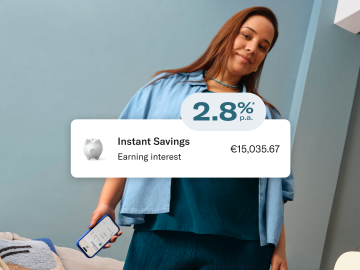

Start earning interest

No deposit limits,** simple conditions, and full flexibility. Discover N26 Instant Savings, the easy-access savings account available at no extra cost in the N26 app.N26 Standard customers get 2.8%* p.a. interest on their savings. Prefer 4%* p.a.? Choose N26 Metal.

More about the Instant Savings account

Stocks and ETFs the simple way

How about investing in your future without having to leave your banking app? With N26, you can buy stocks and ETFs right from your phone. Get 15 free trades every month when you upgrade to N26 Metal — and 5 with N26 You.

Discover Stocks and ETFs

Your virtual N26 Mastercard

After opening your free bank account, get immediate access to your virtual N26 Mastercard. Add it to your mobile wallet, and start using it right away! Use it in shops, online, or at any ATM that supports contactless withdrawals. Plus, enjoy unlimited free ATM withdrawals in the Eurozone!If you prefer to have a physical card, you can order it directly in the N26 app for a €10 delivery fee.

Relax with total protection

When it comes to online banking, safety is everything. Your free bank account comes with advanced security features, like Mastercard 3D Secure—that is, two-step authentication whenever you shop online. Thanks to biometric authentication, you’re also protected from unauthorized access. And as N26 is a fully licensed bank, your deposits are secured up to €100,000 by the European Deposit Protection Fund.

More than a bank account

CASH26

Need cash in hand? Use CASH26 to withdraw and deposit cash at more than 2,000 partner stores in Austria.

Instant push notifications

Whether you’re getting paid or shopping online, push notifications after every transaction mean you’ll always know what’s happening with your money.

MoneyBeam

MoneyBeam lets you send, receive, and request money from other N26 customers instantly, with just a few taps in the app.

SEPA Instant transfers

Your N26 bank account supports incoming SEPA Instant Credit transfers. This way you can get your paycheck and other payments even faster.

Save like a pro with N26 Spaces

N26 premium customers get access to exclusive features that make saving money second nature. Create up to 10 Spaces sub-accounts, assign them a savings target, and instantly set money aside from your main account with drag-and-drop.Automate your savings with Rules, so you can send recurring transfers to your space without lifting a finger. Collect your spare change with Round-Ups, the feature that rounds up each card purchase to the nearest euro and moves the difference into your chosen space.

Go premium to unlock 10 Spaces

Get insights into your spending

Track your spending in real time with N26 Insights—a feature that automatically categorizes your payments as it happens. Get a Monthly Wrap-Up of your financial habits, and learn to budget better along the way.

Chat support–right in the app

Have a technical problem or a question about your free bank account? Our N26 specialists are here to help—and we speak German, English, French, Italian or Spanish. Contact us via the in-app chat function, or find answers to frequently asked questions in the Support Center.

Visit our Support Center

Find the bank account for your lifestyle

With an N26 bank account, you never have to worry about waiting times or finding a local bank branch. Simply open your bank account in a few minutes, directly on your smartphone. The process is completely free of paperwork, and completely straightforward. Want even more out of your bank account? Check out our premium accounts, packed with exciting benefits such as special discounts, saving and budgeting tools, an insurance package, and much more.Frequently asked questions

- What are the requirements for opening a free bank account?

- How can I open a free bank account at N26?

- What are the advantages of having an N26 Standard account?

- How much does a N26 bank account cost?

*The interest rates are based on your N26 membership: 2.8% for Standard, Smart, and You, and 4% for Metal. The interest rates are variable and subject to change in the future.

**The money in your bank accounts — including N26 Instant Savings — is protected up to €100,000 by the German Deposit Guarantee Scheme.