Open a bank account online in minutes

Ready for a bank account you’ll actually love? Then you’re ready for N26. Transfer, receive, and manage your money right in your N26 app. Open your dream bank account in minutes—directly from your smartphone. No paperwork, stress, or waiting times. Just intuitive, easy mobile banking that works.

Sign up

Hit the button below and enter your personal details in order to create your account.

Verify your identity

Please have a valid ID at hand. We don't have branches so you can verify your identity within the app.

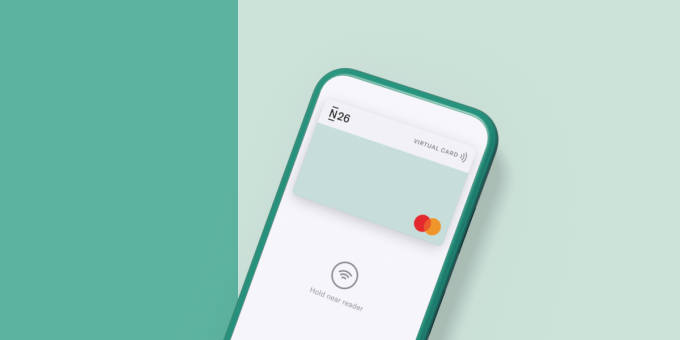

Add your card to your wallet

Your N26 virtual debit card is ready to use.

Enjoy your N26 account!

You're good to go! You can already top up your account and start using your virtual card.

N26 Standard— free account, no commissions, and with Bizum

Get a free bank account in minutes and easily manage your money right from your phone. You’ll get intuitive features like N26 Insights that give you more control over your finances, and push notifications for every transaction. You can send, receive and request money immediately with Bizum, Plus, enjoy 3 free ATM withdrawals per month within the Eurozone.

Get N26 Free accountGrow your savings by 2.26% AER — only with N26

With N26 Instant Savings, your savings can earn you interest — and you can still dip into it whenever you need. Join N26 and start growing your savings:

- 2.26% AER interest calculated daily, paid monthly

- No minimum or maximum deposit limits

- No conditions or fees

- Instant access

- Available with free and premium N26 bank accounts

N26 features you’ll love

Get a virtual or physical debit Mastercard

Your debit Mastercard is accepted worldwide and offers zero foreign transaction fees—as well as SecureCode authentication for extra security.

MastercardVirtual card

Connect your virtual card to Apple Pay or Google pay, and start spending right from your mobile wallet the minute you open your account.

Learn more about N26 virtual cardBudgeting tools

From instant push notifications to spending limits to in-depth features like N26 Insights, you’ll have all the tools you need to stay within budget.

Learn more about BudgetingInstant payments

Send or receive money 24/7, and top up your account in seconds with Bizum. Plus, easily transfer money to other N26 customers via MoneyBeam.

Learn about Instant payments3D Secure for online payments

Shopping online? Your free bank account is equipped with Mastercard’s 3D Secure (3DS)—an advanced two-factor authentication step that keeps your money safe.

3D SecureSplit the bill

Choose between splitting the bill evenly or assign custom amounts to each person, so everyone pays their fair share.

Split the billYour money is safe with deposit protection

N26 is a German bank operating in Spain with a full European license, giving you the best of both worlds. Get a Spanish IBAN for all your local payments, and rest assured with the German Deposit Protection Scheme—the funds in your free bank account are guaranteed up to €100,000.

Switch banks the easy way with N26

We’ve partnered with finleap to make switching accounts easier than ever. Here’s how it works:

- Open an N26 account on the N26 mobile or web app

- Head to My Account and scroll to Switch to N26. Alternatively, use the N26 bank account switching website, and log in with your old bank details.

- finleap will automatically recognize your direct debits, incoming payments and standing orders—simply select the ones you want us to transfer to your N26 account.

- Confirm the account switch—and you’re done!

Find a plan for you

N26 Standard

The free* online bank account

- A virtual debit card

- Free payments worldwide

- Up to 3 free withdraws

- Deposit protection

N26 Smart

The bank account that gives you more control

- Free Virtual Card

- Up to 10 Spaces sub-accounts

- Support Center phone number

- Round-ups

N26 You

The debit card for everyday and travel

- Up to 5 free withdrawals in the Eurozone

- Flight and luggage delay cover

- Medical emergency cover

- Winter activities insurance

N26 Metal

The premium account with a metal card

- An 18-gram metal card

- Up to 8 free withdrawals in the Eurozone

- Purchase protection

- Phone insurance

FAQs

Is N26 a bank?

N26 is the first 100% mobile bank to be granted and operate with a full German banking license from BaFin. That means your money is fully protected — both in your bank account and Instant Savings account — up to €100,000 by the German Deposit Protection Scheme. We currently operate in 24 markets worldwide and have over 8 million customers.

How much does it cost to open a bank account?

N26 Standard is a free bank account. There are no account maintenance fees or minimum deposit amounts for this online account. N26 Smart, You, and Metal premium accounts cost a monthly fee. For more information, visit our website to compare accounts.

What do you need to open a bank account?

To open an N26 bank account, you must meet the eligibility criteria and an official identity document accepted in the country where you live. If you do, you can simply register via the N26 WebApp on desktop or the N26 app on your smartphone. It only takes a few minutes to open a bank account, and there’s no paperwork involved. You can start using your account right away once your identity is verified.

What documents do I need to open a bank account?

In order to open a bank account with N26, you must have a government-issued ID. Don’t worry, there’s no fussy paperwork or long wait times involved—just present your valid ID during a quick call and you’ll be up and running. See the list of valid documents here.. It’s worth noting that you’ll also need a smartphone to use your account, and must live in an eligible country where N26 operates.

How old do you have to be to open a bank account?

You’ll need to be at least 18 years old to open a bank account with N26.

Can I open a bank account online?

Opening a bank account online with N26 is simple. Just head to your app store and download the N26 app. Then, create your account and choose between an N26 Standard, Smart, You, or Metal plan. After that, you’ll need to verify your identity during a brief call with us. Once that’s done, pair your account with your smartphone and start spending and saving the N26 way!

How long does it take to get an N26 debit card?

Once you have successfully completed the N26 account sign-up process, you will immediately have access to your virtual N26 debit Mastercard on your smartphone. Link this to Google Pay or Apple Pay to start spending immediately. If you ordered a physical card or your account includes one automatically, this will typically arrive via post in 5 to 7 business days.

Can I use any N26 account to make and receive Social Security payments?

Yes. You can use any of our N26 plans, as long as your account has a Spanish IBAN (starting with ES) to make and receive payments from Spain’s Social Security. This includes both our free and premium personal and business accounts.

Which Spanish bank can I switch from?

You can easily switch your bank account to N26 from almost every Spanish bank! Just type in the name of your current bank, whether it’s Bankia, BBVA, Santander, ING, Sabadell or CaixaBank. Discover how to switch banks with our tool to facilitate the process.