Risk indicator for all N26 accounts.

1/6

1/6 This number is indicative of the risk of the product, 1/6 being indicative of lower risk and 6/6 of higher risk.

N26 is a member of the German Deposit Guarantee Fund. The fund guarantees deposits up to 100,000 euros per account holder and entity.

N26 Business Smart

The business bank account to spend and save in confidence

Discover a better way to manage your money with N26 Smart—the business bank account for freelancers and the self-employed that offers 0.1% cashback on all card purchases.

5% discount on your freelancer fees*

If you're self-employed, we'll refund 5% of your fees for 12 months. All you have to do is set up a direct debit from your N26 Business account to pay your freelancer fees before April 30th 2024.

Learn more

A colorful Mastercard that fits in with you

Customize your business bank account with a debit Mastercard in a choice of 5 colors—Ocean, Sand, Rhubarb, Aqua or Slate. Enjoy 5 free ATM withdrawals per month, and make card payments even before your physical card arrives. Additionally, relax on your business trips while you make unlimited payments abroad with no fees, in any currency.

Grow your savings by 2.26% AER — only with N26

With N26 Instant Savings, your savings can earn you interest — and you can still dip into it whenever you need. Join N26 and start growing your savings:

- 2.26% AER interest calculated daily, paid monthly

- No minimum or maximum deposit limits

- No conditions or fees

- Instant access

- Available with free and premium N26 bank accounts

0.1% cashback on all card payments

The more you spend, the more you save with N26 Business Smart. Get 0.1% cashback on all the payments made with your N26 Mastercard debit card, and reinvest it back in your business. This cashback is credited directly into your N26 bank account each month so you don’t have to do anything from your side.

Full control of your business spending

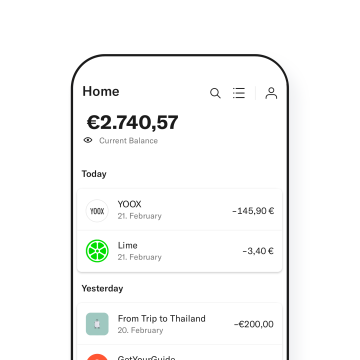

Expense tracking

Stay up to date with where your money goes each month, and learn from your spending habits with Statistics—a tool that automatically categorizes your expenses.

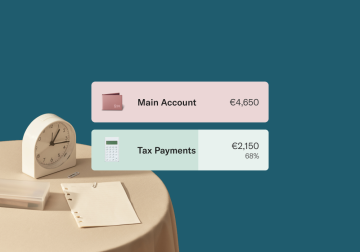

Rules for Spaces sub-accounts

Set up Rules to move money automatically between your Spaces sub-accounts and your main account—select a frequency, an amount, a date, and you’re good to go!

Your bank, always by your side

N26 Business Smart will make you forget what queuing at the bank once felt like. Access your business bank account at any time from your smartphone, or the WebApp.

All your documents in one place

Download your bank statements as PDF or CSV files in seconds. You can also add custom tags to your transactions to find them easily.

Budget like a pro with Spaces

Make some space for your projects—and your money—while discovering how to budget in the most effective way. Create up to 10 sub-account for upcoming business expenses, and even invite up to 10 other N26 users to join to save up for common goals. And enjoy an even faster way to stash away money with Round-ups—enable the feature to automatically round up each card purchase to the nearest euro, and save the difference in a space.

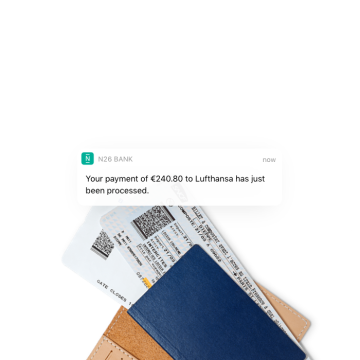

Discover SpacesMove money from A to B with MoneyBeam and SEPA instant

When it comes to money, nobody likes waiting. Send and receive money instantly among N26 users with MoneyBeam, and ask your clients to pay you via SEPA Instant transfers. Your payments will be with you in a heartbeat.

Discover instant payments

Keeping your account secure

3D Secure

Add an extra layer of security to your online purchases with Mastercard 3D Secure, the most advanced two-factor authentication technology.

Real-time notifications

Receive push notifications on your smartphone after all account activity, and always stay informed of every incoming and outgoing transaction.

Smart ID

Access your bank account faster and safer by using your fingerprint or face ID when logging in.

Your funds are protected up to €100,000

We’re a fully licensed European bank, and whatever happens, your funds are protected up to €100,000.

Customer Support via phone and chat

Whether you need our help or just have a question, our Customer Support is available for you 7 days a week, in multiple languages–Spanish, English, French, German and Italian. Feel free to visit our Support Center—packed with answers to the most frequently asked questions—reach out to our specialists via in-app chat, or simply call our customer service hotline and speak to a real human.

Special offers to move your business forward

Access a wide range of exciting partner offers, hand-picked to help you make the best out of your business. Explore deals and discounts from the likes of Google Ads and Fiverr, and treat yourself to perks from big names such as Blinkist or Lime for that perfect work-life balance.

View partner offersThe business bank account to better manage your money

Sign up for N26 Business Smart for only €4.90 per month and enjoy its multiple premium banking features—all designed to help you better manage your money. And of course, get 0.1% cashback on all your card purchases.

TIN 0%, APR: -1.17% for a scenario in which a daily balance of €5,000 is maintained consistently for 1 year, applying an annual nominal interest rate of 0% and the monthly cost of the account of €4,90/month. The settlement of the account is made monthly.

Everytime you make a transaction using your N26 card, we round it up to the next full-euro amount. For instance, if you spend €15.20 at a restaurant—and you activate Round-ups—we’ll automatically round this amount up to €16. The remaining €0.80 will be transferred to your selected space.

FAQ

What are the benefits of an N26 Business Smart bank account?

N26 Business Smart is a premium membership bank account that comes with a colorful debit card and N26 features to spend and save with confidence –like Statistics, which allow you to keep track of your expenses in real time– and 10 Spaces sub-accounts –including Shared spaces– to budget your money and achieve your financial goals. You’ll also get exclusive partner deals, 0.1% cashback, 5 free ATM withdrawals per month and free foreign currency payments worldwide. See T&C’s for full details and availability.

Do I need a business bank account if I’m self-employed?

The N26 Business Smart bank account is designed precisely for freelancers and self-employed, and you have to use your personal name and surname. A business bank account is a smart and efficient way to separate your personal spending from your business.

How do I open an N26 Business Smart account?

To open an N26 Business Smart account, you must meet our eligibility criteria. If you do, simply register on our website, or by downloading the N26 app onto a compatible smartphone. Opening an account takes only a few minutes and is done without paperwork. Once you’ve verified your identity, your bank account will be ready to use.

For more information on opening an N26 You bank account, as well as the documents that you need, visit our Support Center.

Should I open the account with my personal name or with my business name?

To sign up for N26 Business you have to use your personal name and surname. The N26 Business account is designed for self-employed and freelance users doing business under their own name. That means you can’t have your company’s name on the account or card.

How to open a free N26 bank account?

To open your free online N26 Standard bank account, you must meet the eligibility criteria. If you do, simply sign up via the N26 website, or download the N26 mobile app onto your compatible smartphone.

Opening your N26 Standard bank account requires no paperwork, and only takes a few minutes. Just remember to have an official ID ready—once we’ve verified your identity, your N26 Standard bank account will be ready to use right away.

How do I get my cashback on Mastercard purchases?

Since N26 Business Smart is an online business bank account, you’ll receive your 0.1% cashback on all Mastercard purchases directly into your account. This will automatically be deposited on a monthly basis. You don’t have to take any additional steps!

Can I have a personal N26 bank account and an N26 Business bank account at the same time?

If you’ll use your account for business purposes we recommend you to open the N26 Business Smart account from the beginning, as it’s currently not possible to have two separate N26 accounts at the same time.

Can I use my N26 Business Smart account for personal spending?

N26 Business Smart is the online bank account designed for freelancers, therefore you’re expected to use it only for business purposes. You may use it to receive payments from customers, or for spendings related to your business activity such as traveling.

What are the implications of N26 being a collaborating entity with Seguridad Social and Hacienda?

This means that you can receive benefits to which you are entitled to from the Spanish Social Security and SEPE directly on your N26 account (e.g. pension, sick leave, unemployment, Minimum Living Income or other types of benefits). In addition, if you are self-employed or a freelancer, you can also pay your self-employment fees using your N26 account.

How do Round-up Rules work?

Everytime you make a transaction using your N26 card, we round it up to the next full-euro amount. For instance, if you spend €15.20 at a restaurant—and you activate Round-ups—we’ll automatically round this amount up to €16. The remaining €0.80 will be transferred to your selected space.

Which Spanish bank can I switch from?

You can easily switch your bank account to N26 from almost every Spanish bank! Just type in the name of your current bank, whether it’s Bankia, BBVA, Santander, ING, Sabadell or CaixaBank. Discover how to switch banks with our tool to facilitate the process.